CNNIC report shows that Sogou users have the highest income level

The "2009 China Search Engine User Behavior Research Report" recently released by the China Internet Network Information Center (CNNIC) shows that compared to the monthly income structure of search engine users in 2008, the income distribution structure of the search user group in 2009 has not changed significantly. Currently, among China's search engine users, those with an income below 1000 yuan account for approximately 42.9%, users with a monthly income between 1001-2000 yuan make up 27.3% of the total, and users with a monthly income over 2000 yuan account for 29.8% of the overall total.

From the perspective of penetration rates of search engines across various income groups, the use of search engines is basically positively correlated with income level; as income levels increase, the penetration rate of search engines gradually grows. Compared to the overall income level of internet users nationwide, the monthly income level of search engine users is higher than the average monthly income level of all internet users nationwide, indicating a relatively higher consumer payment capacity. As one of the basic applications on the internet, search engines possess significant commercial value.

Figure 1: Search Engine User Income Distribution

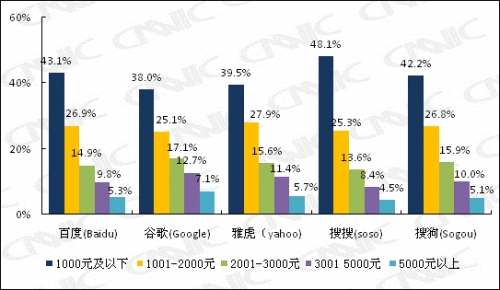

CNNIC research shows that among search engine users with higher payment capabilities, they typically use more than two search brands. However, when comparing the income distribution of first-choice users for Chinese search engine brands, the average income level of Sogou’s first-choice users is significantly higher than other search brands, indicating that its users generally have a high payment capacity and thus represent the highest commercial value. Conversely, the income levels of SouSou and Baidu users are lower, especially for SouSou users, where the group with an income below 1000 yuan accounts for 48.1%.

According to the CNNIC report, among people with an income below 1000 yuan, the proportion of Sogou users is the smallest, followed by Baidu, while SouSou has the highest proportion. The fact that SouSou has a higher proportion of low-income users is unsurprising, as most of its users come from Tencent QQ, which has traditionally focused on younger demographics. This group primarily includes students without income and young individuals with unstable jobs. This suggests that SouSou's commercial value is significantly discounted. For the domestic search engine leader - Baidu, despite having a large market share and numerous users, the income level of its users ranks behind Sogou. Considering Baidu's overly commercialized approach, this situation is expected.

Figure 2: Income Distribution of Preferred Users Across Various Search Engines

From a product perspective, currently, many professional and high-end users' demands for search engines have shifted from general information searches to more precise content searches. For instance, at the most basic web search level, high-end users need to find the most useful information in the shortest time possible, and they tend to be annoyed by a large amount of ineffective commercial information. Sogou's third-generation search engine technology ensures the validity of information and continues to update algorithms. Additionally, it performs differentiated information retrieval for different keywords, avoiding repetitive and ineffective information. This saves users a significant amount of valuable time, making high-end users more inclined towards Sogou. On the other hand, professionals and high-end users are increasingly demanding in the vertical search domain. For example, the launch of color tone search services catering to professional designers' needs for image and color searches, and multiple personalized search services tailored to musicians' music search needs... Sogou was highly sensitive to these trends and began early in-depth exploration and meticulous work in the vertical search field. Currently, in vertical search areas such as images and music, the loyalty of professionals to Sogou is extremely high, prompting a continuous upward trend in the proportion of high-quality individuals within Sogou's user base.

As the commercial value of Sogou's overall user base increases, Sogou's traffic naturally becomes the most commercially valuable platinum traffic. A search engine dominated entirely by platinum traffic allows companies to achieve targeted precision marketing, enhancing marketing effectiveness exponentially. CNNIC's reports over several consecutive years show that compared to other search engines, Sogou's advantage in platinum traffic is further increasing, aligning perfectly with the industry insiders' positive outlook on the commercial potential of Sogou search.