Evaluation of the IM market "old hands and new forces" What has Feixin changed?

Analysys International's latest report said that the number of active users of China Mobile's Feixin has reached 13.28 million, rising to fourth place in the domestic IM market.

● According to China Mobile's recent data, the number of registered Feixin users has reached 66 million, challenging the dominant positions of QQ and MSN. Many users are switching from QQ and MSN circles to the Feixin trenches.

● iResearch predicts that the overall scale of the IM market will rapidly increase to 1.44 billion yuan by 2010.

● Feixin is mainly a wireless communication application that will bundle MMS, blogs, and other content for the 3G era. The industry expects it to influence the mobile internet industry chain.

A reporter's friend, Mr. Niu, habitually uses instant messaging tools at work to communicate with business partners. He usually uses QQ and MSN the most. Now, he has also opened a China Mobile Feixin client. Despite having several tools running simultaneously, making his office computer with only 256MB of memory run slowly, Mr. Niu still loves this little gadget called Feixin. "Sending messages to phones with it doesn't cost money." It is precisely because it meets users' seemingly simple demands that China Mobile's Feixin can quickly enter the desktops of QQ and MSN users within a short time, competing on equal terms. Feixin is gradually changing users' usage habits and concepts.

In just over a year, Feixin has achieved the miracle of developing 66 million registered users, and China Mobile has quickly become one of the key forces in the instant messaging (IM) market, challenging the traditional dominant positions of Tencent and Microsoft.

Market research company iResearch released data showing that China Mobile's instant messaging market revenue will reach 670 million yuan in 2006. In the next three years, the related market will maintain a growth rate of more than 20%, and by 2010, the overall scale of this market will rapidly increase to 1.44 billion yuan. The huge market prospects have become the driving force for telecom operators to enter the instant messaging market.

The reasons go beyond this. According to China Mobile, Feixin is not just a simple IM tool. It is mainly a wireless communication application, and in the future, it will bundle content such as MMS, ringtones, blogs, and streaming media, becoming an important application platform for mobile operators in the 3G era.

The changes it brings will not be limited to the personal data business application level in the future, but may also affect the entire mobile internet industry chain.

User Numbers "Surge" Changing IM Situation

At the beginning of June, the much-anticipated instant messaging product (IM) "Feixin" of China Mobile officially went commercial. During the pre-commercial stage, despite China Mobile not doing large-scale publicity and promotion, the expansion speed of "Feixin" could already be described as "excellent". The reporter obtained the latest data from China Mobile Corporation: after the official commercial launch of Mobile Feixin, the number of registered users has approached 66 million, and this figure continues to grow.

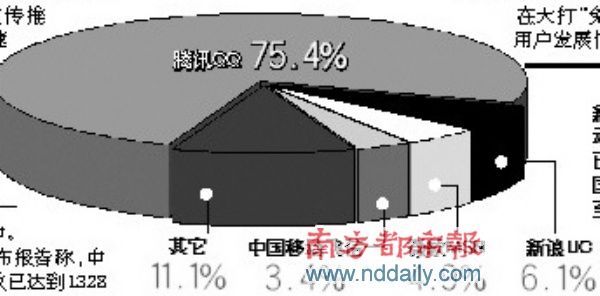

The latest report released by Analysys International stated that the number of active users of China Mobile Feixin has reached 13.28 million, and its ranking in the domestic instant messaging market has risen to fourth place, following Tencent QQ, Sina UC, and MSN. This report titled "China Instant Messaging Market Quarterly Monitoring Q3 2007" showed that in the third quarter of 2007, the number of active accounts in China's instant messaging market increased by 3% quarter-over-quarter, reaching 388 million, growing by 25% compared to the same period last year, maintaining a stable growth trend. From the market structure, Tencent QQ, Sina UC, Microsoft MSN, and China Mobile Feixin occupy market shares of 75.4%, 6.1%, 4.9%, and 3.4%, respectively.

Despite being the undisputed "leader" in the entire instant messaging market, Tencent QQ is still facing challenges from Feixin in the mobile IM sector. In just half a year, the number of registered users of Feixin has surpassed all competitors in the mobile IM field. By the first quarter, Tencent's total number of mobile and telecommunications value-added service users was only 10.2 million. Although MSN did not disclose the specific number of mobile MSN users, it was reportedly in the millions. Even PICA, which focuses on developing mobile instant messaging tools, had around 9.5 million users, clearly not in the same league as the tens of millions of users of Mobile Feixin. According to the person in charge of Guangdong Mobile Feixin business, since its official commercial launch in June this year, the number of active Feixin users in Guangdong each month is between 2 to 3 million, and it is increasing monthly.

In fact, the rapid "ascension" of Mobile Feixin reflects the determination of China Mobile Group to fully support Feixin. Observant people would notice that Feixin's IM ID starts from 4XXXXXXXXX (400 million numbers), indicating China Mobile's ambition to install Feixin on most of its current 450 million users. After Feixin officially went commercial, China Mobile clearly stated that it does not intend to charge a monthly functional fee in the initial stage, and there is no timetable for full charging.

In addition to the "free" strategy, the development of Feixin users has been included in the group's performance evaluation targets for this year. Under this background, various branch companies have bundled user promotion with traditional business marketing: mobile users in Guangzhou recently received a text message from 10086: as long as they log into Feixin using their phone or computer more than five times by mid-November, they will receive a 10-yuan phone credit; Guangxi Mobile launched a "universal Feixin popularization campaign" in Nanning, attracting 31,000 users in nine days through service hall marketing and WapPush methods; Hunan Mobile used a series of marketing activities like "Double Fly Jiuzhaigou Four-day Tour" and "Weekly Draw for 100 KFC Meal Packages" to accelerate Feixin's expansion...

Besides expanding the user base through its own channels, China Mobile has also collaborated with terminal developers to create customized products to further attract users. In June this year, Motorola had already pre-installed the "Feixin" function on 11 models of phones, including the highly favored ROKR Z6 and KRZR K1 models. Users do not need to download or install client software to use Feixin products.

Direct Confrontation Among IM Powerhouses

Many industry analysts believe that China Mobile's aggressive entry into the IM domain will inevitably trigger significant changes in the traditional landscape of this field. Before the end of last year, China Mobile announced the termination of all cooperation with Tencent and MSN in wireless instant messaging services, leading to speculation that China Mobile hopes to monopolize this market. Correspondingly, Mobile QQ by Tencent and Mobile MSN quickly made a "counterattack". In December 2006, Tencent quietly announced that starting from December 20th, its Mobile QQ would be permanently free, whereas previously users had to pay a monthly subscription fee of 10 yuan for this service. In April 2007, the MSN department of Microsoft China announced that the MSN mobile client for the Chinese market would be available for free download and use.

A battle for user acquisition in the instant messaging market has already begun. Despite China Mobile's relevant personnel expressing from various channels that Feixin will not directly confront QQ and MSN, head-to-head competition is unavoidable. A senior technical staff member involved in the Feixin project revealed that Mobile QQ, Mobile MSN, PC QQ, MSN, and Skype have all been listed as internal competitive targets for Feixin.

Feixin is not guaranteed to win. Although Feixin has an absolute advantage in the number of users in the mobile IM field, it has no advantages compared to QQ and MSN in the traditional Internet IM market. Taking QQ as an example, Tencent's registered user count has reached 597 million, with 253 million active users. Although the controllability of the traditional Internet is less than that of the mobile network, the "stickiness" cultivated among QQ users over a long period and the cost of switching make it difficult for people to abandon it. Tencent's market value and profit model are the best proof.

Analyst Zhang Yanling of Analysys International believes that currently, whether it is Tencent QQ targeting the mass entertainment market, MSN aimed at business professionals, or Skype with its voice feature, all satisfy different functional and application needs of users. Many users have chosen one or more IM tools suitable for themselves based on their own needs, forming certain usage habits. Attracting users with unique functional advantages has become the foundation for the survival of some Internet IMs. In comparison, China Mobile's Feixin business has yet to form a clear market positioning on the Internet platform. In the context of multiple coexisting Internet IM tools, the lack of unique differentiation from existing Internet IM functions makes it difficult for users to find reasons to replace other IMs with Feixin.

Another pressure lies in the difference between "passive use" and "active use" by users. Due to China Mobile's promotion of Feixin, measures such as free services or call credit subsidies have been taken to expand the market. Whether users are actively seeking the product due to its functionality or attracted by free services or call credit subsidies needs to be evaluated. Furthermore, interoperability between IMs of telecom operators and with Internet IMs will affect the further expansion of Feixin's user base.

For China Mobile, if it fails to address the issue of Feixin's unique value positioning, a large-scale user loss in the future will be inevitable.

Does Feixin Initiate the Mobile Internet Era?

"Feixin is far more than just a product for China Mobile," said telecommunications expert Chen Jiniao. Against the backdrop of 3G, Feixin is an important step in China Mobile's future strategy. Through the Feixin platform, China Mobile can offer many value-added services such as online games, online shopping, virtual communities, and mobile payments. At the same time, it will help promote the integration of mobile IM and Internet IM, meeting users' demand for interaction between two networks, and becoming an important application for interactive services across these two networks.

Feixin's goal actually targets the future personal data services market. An insider from China Mobile revealed that Feixin is not just a simple IM tool. It primarily focuses on wireless communication applications and in the future will bundle contents such as multimedia messaging services (MMS), ringtones, blogs, and streaming media, becoming an important application platform for mobile operators in the 3G era.

Vice President Sha Yuejia of China Mobile emphasized: "The formal commercial launch of Feixin marks a new milestone in the diversification, comprehensiveness, and multifunctionality of China Mobile's communication value-added services. The greatest significance of Feixin lies in its surpassing of instant messaging tools, becoming a new type of information platform based on personal instant communication. People can not only communicate freely on this platform, but also realize comprehensive services such as gaming, inquiries, music, and video calls."

The changes brought by Feixin are not limited to the personal application level. Some analysts believe that Feixin might initiate the mobile internet era. Feixin is no longer just a value-added service platform. China Mobile attempts to build a platform similar to Microsoft Windows through Feixin, thereby influencing the direction and path of the entire industry.

Market analysts pointed out: "China Mobile has two advantages that others do not possess: one is the longitudinal bundling capability of 24-hour connectivity between mobile phones and the internet, and the other is the horizontal integration capability of interconnection with other software." Facing 500 million mobile phone users and the strong comprehensive strength of operators like China Mobile, any mobile IM wants to cooperate with operators, and the broad space of future mobile internet will attract more mobile IM software. The entire industry chain will seek new symbiotic ways. In fact, while competing with Feixin, Tencent QQ became a strategic partner in China Mobile's instant messaging field at the end of last year. QQ users can interconnect with Feixin mobile users. Additionally, according to relevant sources, the work of interconnecting Feixin with NetEase Bubble and other instant messaging tools is also underway.

Dean Lu Tingjie of the School of Economics and Management at Beijing University of Posts and Telecommunications saw changes brought by Feixin from another perspective: "Future communication is about letting the network find people, rather than people considering which network to use. Feixin integrates each person's mobile phone with their personal account on the internet, truly realizing the promise of being omnipresent and omnipotent."

"On the basis of not avoiding competition with existing IM service providers, actively developing wireless internet application services" might be the real vision hidden behind the official statements during the early stages of Feixin's commercialization.

Evaluation of Old and New Forces in the IM Market

[Main Evaluation Characters]

China Mobile Feixin, China Unicom Lingxin, China Telecom Chaoxin, Tencent Mobile QQ, Mobile MSN

As premium value-added services like SMS, MMS, and ringtones gradually become old news, and with various packages prevailing, tariffs continuously decreasing, and ARPU values constantly declining, what can still become a new market growth point in the eyes of operators? Since this year, China's three major operators—Mobile, Unicom, and Telecom—have started experimenting with the IM instant messaging market, with "free" and "wireless chat" becoming their shared slogans. However, on this fertile ground where "life never stops, chatting never ends, and wealth flows endlessly," operators are not pioneers. Prior to this, Tencent QQ and Microsoft's MSN Messenger had already extended the battle to the mobile end, allowing users to chat anytime and anywhere.

Setting aside the backgrounds of various IM software currently on the market, focusing solely on topics such as interactive interface, usage method, and tariff collection that concern users, and purely evaluating based on technical experience, how exactly do these software compare? Detailed evaluation segments will provide you with answers.

「Round 1」Background Comparison

Feixin: Launched by China Mobile. Besides basic chat functions, it can be logged in via multiple terminals such as PC, mobile phone, and WAP, achieving seamless real-time communication between PC and mobile phone. Additionally, it offers features such as free sending of SMS to friends, ultra-low fees for voice group chats, and file transfer between mobile and computer, enabling anonymous text and voice communication.

Chaoxin: A comprehensive instant messaging service offered by China Unicom. Chaoxin users can use various means such as mobile phone client, PC client, SMS client, WAP client, and IVR client to access Chaoxin services at any time, enabling real-time exchange of text, emoticons, images, and voice messages between mobile to mobile and mobile to PC.

Lingxin: A comprehensive instant messaging service provided by China Telecom Broadband Online for all China Telecom users. Users can use various means such as Xiaolingtong SMS client, broadband PC client, and future 3G clients to access IM instant messaging services at any time, enabling real-time exchange of multimedia information such as text, emoticons, voice, images, and pictures between mobile to mobile and mobile to PC.

Mobile QQ: Jointly launched by Tencent and China Mobile, it is a way of online chatting tied to a mobile phone, one of the earliest IM software on the mobile end in our country. It is understood that "Mobile QQ" will exit the stage, to be replaced by "Feixin QQ", with the revenue-sharing ratio between Tencent and Mobile remaining unchanged. Tencent admitted that during the migration from Mobile QQ to Feixin QQ, some users unsubscribed, "but the impact on the company's income is not significant."

Mobile MSN: Launched by Microsoft and China Mobile in 2005, Mobile MSN connects with the computer-based Messenger, allowing online adding of friends, managing friend lists and personal settings, and sending text, voice, and instantly captured photos. Additionally, Mobile MSN adds channels to access email and personal spaces.

Summary: Among the five products, three were born within operators and have unique advantages in the mobile communications field. Mobile QQ (Feixin QQ) and Mobile MSN mainly rely on their vast user base and strong user "stickiness" to secure a place in the industry.

「Round 2」Tariff Comparison

Feixin: Confirmed to have no monthly subscription fee, sending messages from a mobile phone to a PC via SMS is charged at normal rates.

Lingxin: No monthly subscription fee during the promotion phase, 5 yuan/month when commercialized, all downstream SMS are free, upstream fees are charged according to local China Telecom rates.

Chaoxin: No monthly subscription fee during the promotion phase, 5 yuan/month when commercialized, sending messages from a PC is free, receiving messages on a mobile phone is free, sending messages via SMS is charged per message.

Mobile QQ: Has completed migration to Feixin QQ, previously lifetime free.

Mobile MSN: No monthly subscription fee, GPRS traffic fees apply when using the client.

Summary: In terms of tariffs, regardless of whether it is a trial run or not, the tariff model adopted by the three operators is almost identical. On one hand, all three services are in the promotional phase, and market response is very important. In this situation, offering free service is the wisest choice. From the perspective of Mobile QQ and Mobile MSN, before migrating to Feixin, Mobile QQ had already become free, and Mobile MSN also announced the cancellation of monthly subscription fees earlier this year. This indicates that under the wave of free services, IM software outside of operators have already made sufficient forecasts about market prospects. Canceling monthly subscription fees is not a fatal blow, and other sources of income are more critical. Regarding sending messages via SMS, all services charge normal SMS fees, which is understandable from the user's perspective and has not caused much controversy.

「Round 3」Client Comparison

1PC End

Feixin: Its PC client resembles MSN, with humanized button arrangements, easy to use, and equipped with many management functions. Convenient activation or deactivation of the service is a highlight. However, in actual use, I found that Feixin runs relatively slowly and consumes a lot of system resources. This has been improved in subsequent versions, but there is still room for improvement.

Lingxin: The PC client software has relatively simple functions, a clean interface, and few customizable options. Because of this, it starts up quickly and consumes fewer system resources during regular operation.

Chaoxin: Like Lingxin, it follows a minimalist design, with relatively simple functions. It performs better than Feixin in login speed and system resource consumption, but slightly worse than Lingxin.

QQ: After years of development, QQ's PC client interface is quite mature and has become a reference for newcomers in the IM market.

MSN: The overall interface style matches well with Microsoft's desktop operating system, with some humanized improvements during development, such as subtle changes to "display as offline" items. It starts up a bit slower and consumes some system resources.

Summary: The PC clients of the three operator IM softwares are not yet mature. Comparatively, Lingxin's PC client stands out for its convenience, low system resource consumption, and fast speed. Chaoxin and Feixin each have their own characteristics.

2JAVA End

Feixin: Powerful functions but complicated steps to use, various operations are smooth enough. The JAVA client of Feixin consumes a lot of system resources.

Lingxin: The JAVA software of Lingxin can be installed on ordinary GSM phones, with an interface that closely aligns with user habits. Note that the JAVA client of Lingxin does not allow registration and requires registration through Xiaolingtong.

Chaoxin: Due to the uniqueness of Unicom's dual networks, Chaoxin has both JAVA and BREW modes, with consistent overall styles and relatively simple to use, but the response speed is slightly slower than Lingxin.

Mobile QQ: Also a mature JAVA software for the mobile end, it operates very similarly to the PC QQ client, striving to restore the classic QQ style in terms of avatars and sound effects on mobile phones.

Mobile MSN: Login speed is faster than the PC end, the overall style is similar to the PC, displaying recent contacts, online status, and blocking. It cannot display offline users or custom categories, but the advantage is that it consumes fewer system resources.

Summary: Essentially, the JAVA versions of each client resemble their respective PC ends. Except for Mobile QQ, the other four JAVA softwares are considered "newcomers" in the mobile instant chat software field. It is believed that JAVA software with lower energy consumption and smaller data flow will be the favorite of users.

3SMS End

Feixin: With China Mobile's large number of mobile users and rich internal network resources, Feixin has inherent advantages. In the process of using SMS as the message transmission method, Feixin is undoubtedly the king.

Lingxin: Due to the relatively small and even decreasing user base of Xiaolingtong, the usage rate of Lingxin's SMS client is lower than Feixin. However, the JAVA client of Lingxin that can be used on mobile phones compensates for this shortcoming.

Chaoxin: Similar to Lingxin in SMS usage, the bottleneck lies in the number of users.

Mobile QQ: Has transformed into Feixin QQ, making this segment irrelevant for discussion.

Mobile MSN: Initially, Mobile MSN maintained a monthly subscription fee of 10 yuan/month when Feixin was launched, causing a large number of users around me to switch from Mobile MSN to Feixin. Soon after, MSN realized the importance of being free.

Summary: Due to its inherent user advantage, Feixin takes the lead. The number of users and interoperability are crucial for the development of an IM software. There is no doubt that instant messaging has become the favorite of the new generation of mobile phone users. In the upcoming 3G era, it will undoubtedly become a new gold mine under the leadership of telecom giants.